st louis county mn sales tax

38 rows St Louis County Has No County-Level Sales Tax. Louis MO 63111 sold for 24000 on May 17 2016.

Duluth Ballot Asks For Higher Taxes To Restore Services Mpr News

Louis County Tax-Forfeited Land Sale Auctions.

. Pay by E-Check for FREE online with Paymentus. The average cumulative sales tax rate between all of. Louis County Board enacted.

Monday - Friday 8 AM - 5 PM. 41 South Central Avenue Clayton MO 63105. While many counties do levy a countywide.

Minnesota Statute Chapter 282 gives the County Board the County Auditor and the Land Minerals Department authority over the management and sale of tax forfeited lands. What is the sales tax rate in St Louis Park Minnesota. Your payment must be postmarked on or before the due date or penalties will apply.

2 baths 2496 sq. This is the total of state and county sales tax rates. Information on timber sales on state tax forfeited land.

If you need access to a database of all Minnesota local sales tax rates visit the sales tax data page. Starting April 1 2015 St. The Minnesota state sales tax rate is currently.

The minimum combined 2022 sales tax rate for St Louis Park Minnesota is. The current total local sales tax rate in Saint. Mail payment and Property Tax Statement coupon to.

Saint Louis County Home Saint Louis County Land Explorer Parcel Tax Lookup Contact Information. Louis County offices are now open to the. The right to withdraw any parcel from sale is hereby reserved by St.

See all other payment options below for associated. Online auction continues October 13 through November 10 2022 at 1100 am. The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects.

Information on timber sales on state tax forfeited land. Multi-family 2-4 unit located at 4504 Minnesota Ave St. The Minnesota Department of Revenue will administer these taxes.

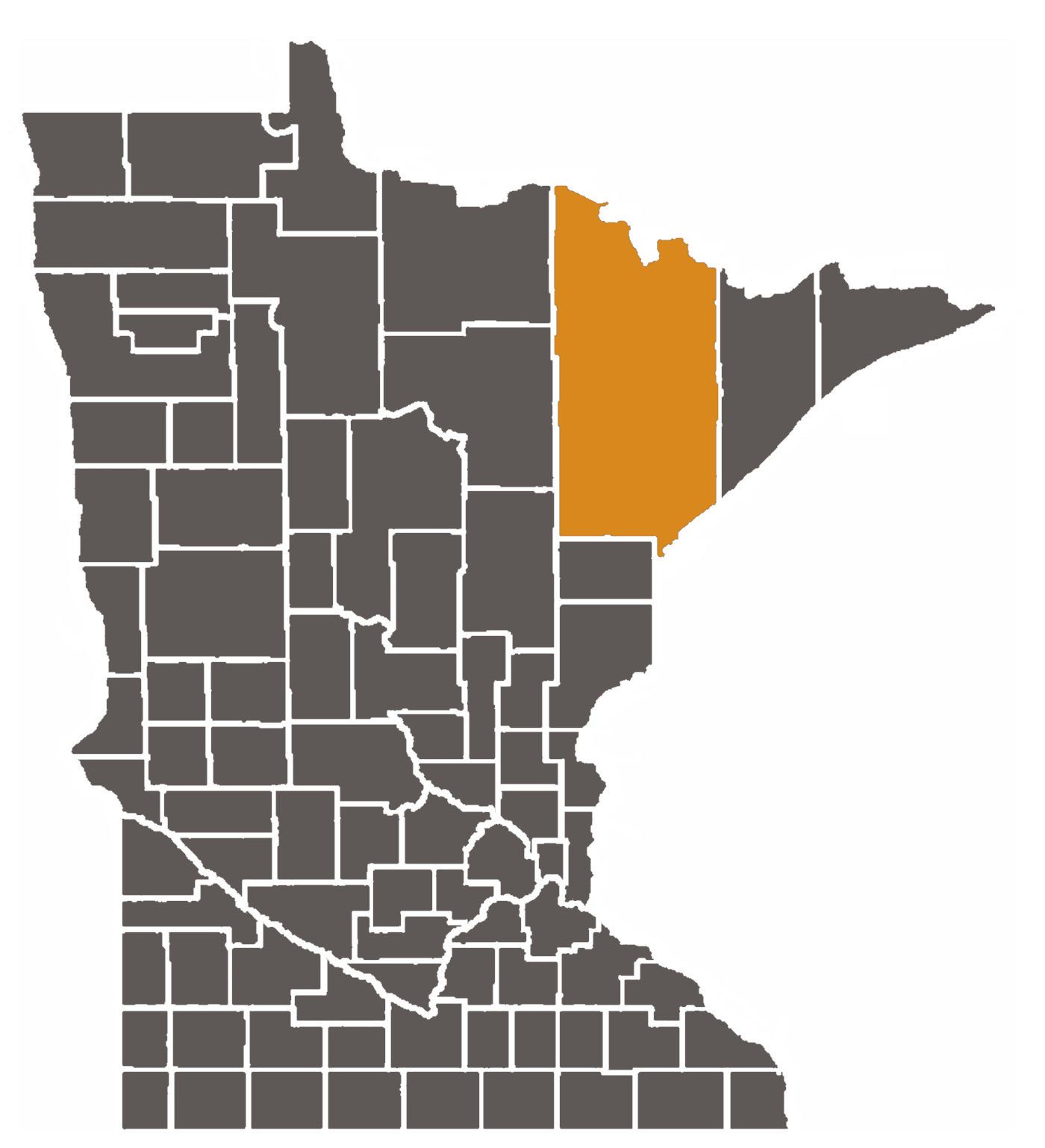

Saint Louis County in Minnesota has a tax rate of 738 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Saint Louis County totaling 05. November 15th - 2nd Half Agricultural Property Taxes are due. The 2018 United States Supreme Court decision in.

Parcel is subject to Public Water visit the MN DNR website for more information. View sales history tax history home value estimates and. Louis County Auditor 218-726-2383 Ext2.

This is the total of state county and city sales tax rates. A full list of these can be found below. The St Louis County sales tax rate is.

3 rows Saint Louis County MN Sales Tax Rate. All contractors or sub-contractors must carry liability insurance and meet. 2022 Minnesota Sales Tax By County Minnesota has 231 cities.

Louis County will have a 05 percent transit sales and use tax and a 20 vehicle excise tax.

Minnesota Sales Tax Small Business Guide Truic

Missouri 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Minnesota Judicial Branch St Louis County District Court Hibbing

Land For Sale Property For Sale In Saint Louis County Minnesota Land Com

402 W Anoka St Duluth Mn 55803 Realtor Com

Land For Sale Undeveloped Land For Sale In Saint Louis County Minnesota Land Com

St Louis County Adds On To City And State Shares Of Sales Tax Duluth News Tribune News Weather And Sports From Duluth Minnesota

Single And One Story Homes In St Louis County Mn For Sale Redfin

Saint Louis County Mn Land For Sale 641 Listings Landwatch

Auditor S Office Responds To Questions About Pre Payment Of 2018 Property Taxes In 2017

0 14 Acres Of Residential Land For Sale In Duluth Minnesota Landsearch

Cook County Increases Its Sales Tax By One Percentage Point The Civic Federation